Wall Street’s major indexes closed the day in red on Tuesday, alongside cryptocurrencies, and precious metals like gold and silver taking some percentage losses. The leading crypto asset bitcoin dropped 5.87% under the $19K region, while the second largest crypto asset ethereum shed 8.7%. Gold’s nominal U.S. dollar value per troy ounce slipped by 0.50%, while silver dropped by 0.74% on September 6. Meanwhile, a recent rise in U.S. Treasury yields has been concerning and one analyst thinks the anomaly could spark an American debt crisis.

Stocks Sink Lower, Crypto Economy Craters, Precious Metals Dip, Traders Await Fed’s Next Move

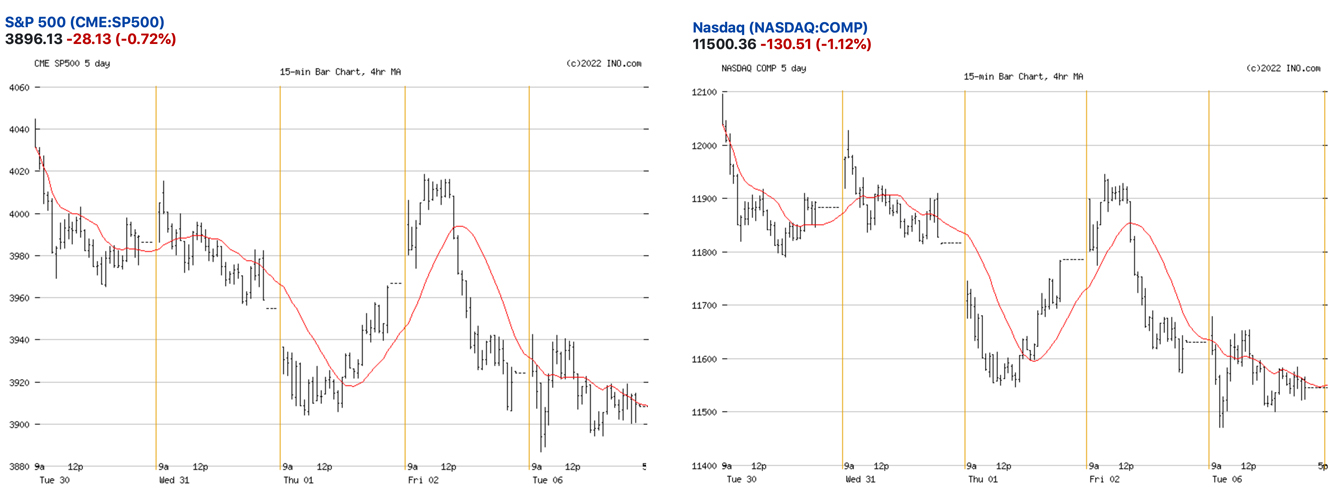

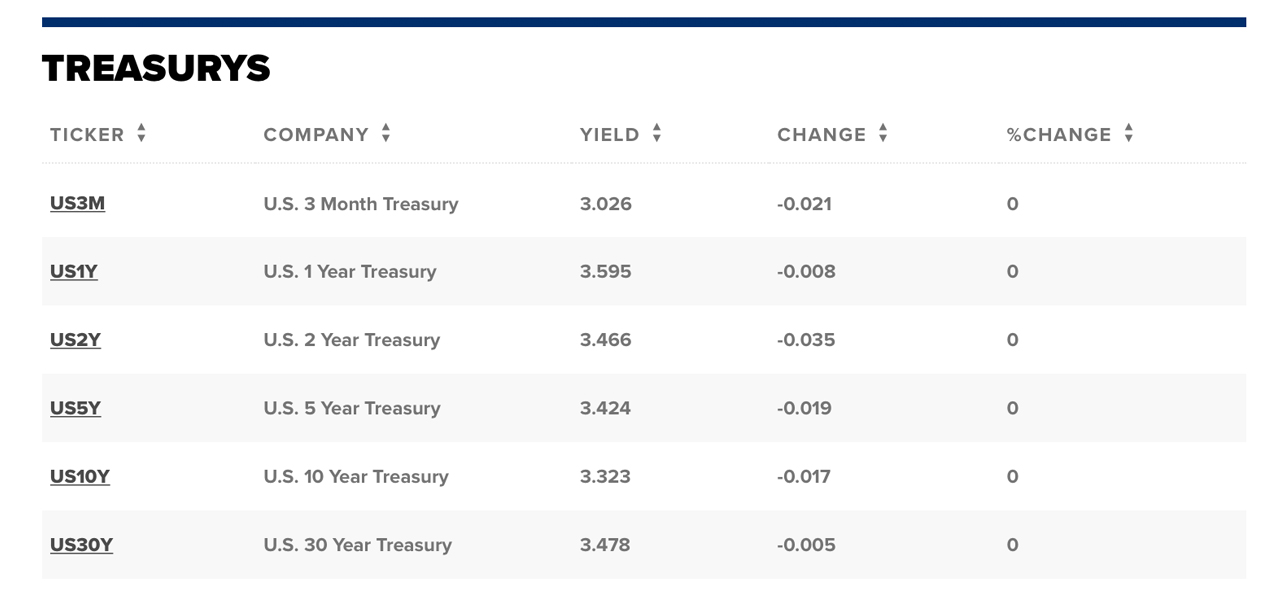

Tuesday was a bloody day of trading for Wall Street traders, gold bugs, and crypto proponents as markets shed significant losses. Investors are starting to weigh in on the upcoming Federal Reserve rate hike, and benchmark U.S. Treasury yields leapt to the highest tier in two months. Nasdaq, NYSE, S&P 500, and the Dow Jones ended Tuesday lower than expectations after the U.S. Labor Day holiday weekend.

Precious metals like gold, silver, and palladium were all down on Tuesday as well. Platinum and Rhodium, however, jumped between 0.71% and 3.97% higher against the U.S. dollar during the last 24 hours. The global cryptocurrency market capitalization of all the existing crypto tokens lost 4.2% during the last day. At the time of writing, on September 7, 2022, at 7:00 a.m. (ET), the crypto economy’s valuation stands at $940.10 billion.

Bitcoin (BTC) dropped by 5.87% on Tuesday, dropping below the $19K price range. Market strategists and traders are waiting for the next U.S. Federal Reserve rate hike on September 21, which is estimated to be around 75 basis points. “You have all this fear that more rate increases are going to happen at the central bank level,” Tom di Galoma, managing director at Seaport Global Holdings in New York, said on Tuesday. “Inflation is not going to dissipate and then you’ve got the quantitative tightening that’s coming pretty rapidly.”

Portfolio Manager Says US Treasury Deviations and Other Market Anomalies Could Spark a ‘Sovereign Default Crisis’

In addition to the U.S. central bank, Christine Lagarde, Luis de Guindos, and the European Central Bank are expected to increase the benchmark lending rate aggressively this week. Michael Gayed, the Lead-Lag Report publisher and portfolio manager, thinks the U.S. could have a sovereign debt crisis.

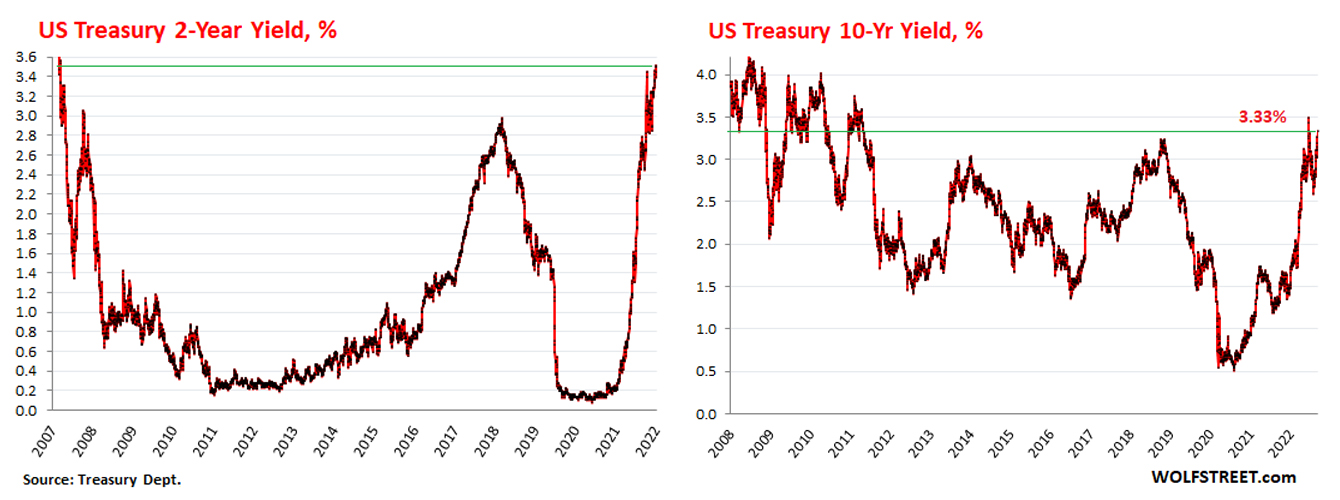

Gayed spoke with David Lin, the anchor and producer at Kitco News, and explained the abnormality with U.S. Treasury yields rising in an unprecedented manner is concerning. Gayed believes if U.S. Treasury yields get too high, it could make it harder for other countries to adhere to debt obligations.

“When you have $170 trillion of unfunded liabilities and $30 trillion of visible liabilities … How could that not be inflationary? Gayed asked Lin during his interview. “The only way to resolve that is to pay down that debt.”

The portfolio manager further noted that Wall Street has suffered through some of the biggest monthly declines this year since the 2008 financial crisis. Skyrocketing Treasury yields, red-hot inflation, and the stock market rout could cause “multiple Black Swans,” Gayed stressed.

“The end result of all this is either some kind of sovereign default crisis, which is a deflation event, or the exact opposite, which is hyperinflation, which results in conditions under which something really bad comes,” the Lead-Lag Report publisher concluded.

Gayed also remarked that the financial crisis he predicts could bring forth a far more authoritarian-style government than we have today. “Something bad could happen, in terms of a new leader that you don’t want to see lead,” Gayed said.

What do you think about the global economy and the recent market downturn affecting stocks, precious metals, and cryptocurrencies? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, CNBC, Wolfstreet.com, Tradingview,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.